Chase Mobile

Download Chase Mobile through Appnomo.com is Safe and Free..

Download Chase Mobile through Appnomo.com is Safe and Free..

Discover the good Apps to customize your Android and provide safe APK to download.

Discover the good Apps to customize your Android and provide safe APK to download.

- Category: Business

- Updated: May 2, 2025

- Size: 382.3 MB

- Requirements: 10 and up

- Developers: JPMorgan Chase

The Description of Chase Mobile

Chase Mobile is the official mobile banking app launched by JPMorgan Chase. JPMorgan Chase is one of the largest banks in the United States, with more than 60 million customers. Chase Mobile is the core carrier of its digital service strategy, widely serving individual users, small and medium-sized business owners and credit card customers.

The app supports iOS and Android platforms and can be used for a variety of financial activities such as account management, transfer payment, credit card management, check deposits, loan viewing, investment tracking, etc.

Screenshot

App Store Performance

With its user-friendly interface, comprehensive functions and high security, Chase Mobile has maintained a very high rating on the App Store and Google Play for many years and is one of the most popular banking apps in the United States.

Features

1. Account overview and real-time management

After logging in, users can quickly view all related account information, including checking accounts, savings accounts, credit cards, investment accounts, loans, etc. The homepage layout is clear, and the balance, transaction records and account dynamics are clear at a glance.

2. Mobile transfer and payment

Zelle payment integration: supports instant transfer to others without handling fees, often used for splitting accounts or small payments between friends.

Inter-account transfer: can quickly transfer money between accounts in this bank or other banks at any time.

Credit card repayment: easily set up automatic repayment, or pay the bill amount in one go.

3. Mobile check deposit

Users can deposit paper checks into their accounts by simply taking a photo, which is simple to operate and avoids queuing at the bank.

4. Bill payment and automatic deduction

Supports automated payment of bills from multiple institutions, such as water, electricity, gas, telephone bills, mortgages, student loans, etc. Users can set payment time, amount and frequency to ensure that bills are paid on time.

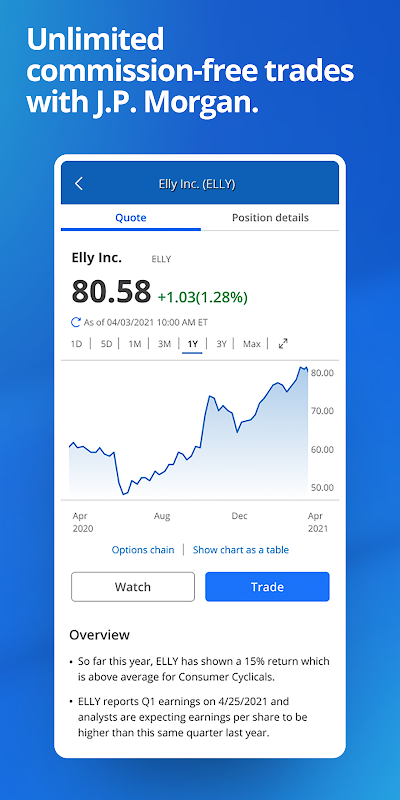

5. Investment and stock trading (J.P. Morgan Self-Directed Investing)

For investors, the Chase App allows users to directly access investment accounts, view market trends, purchase stocks or ETF products, and perform asset allocation and investment tracking.

6. Customer Service and Virtual Assistant

Chase Digital Assistant, a built-in virtual customer service, can provide 24-hour basic assistance, such as checking balances and payment dates. You can also make an appointment with a customer service representative or handle business at a branch directly through the App.

Pros And Cons

Pros

1. Comprehensive functions and one-stop service

From daily banking operations, credit card management to investment transactions, Chase Mobile integrates all financial services into one platform, covering almost all financial management needs of individual users.

2. Simple and intuitive user interface

With simple design, smooth operation, and reasonable account information classification, new users can quickly get started. Important functions such as transfers and repayments are usually completed in two or three steps.

3. High security performance

As one of the largest banks in the United States, Chase has extremely strict security control over the App. Users can flexibly set passwords, perform biometric logins, and quickly handle suspicious operations when they are found.

4. Active updates and technical support

The app is frequently updated to fix bugs or optimize features, and the customer service system responds quickly, allowing users to get support directly through the app.

Cons

1. Not friendly to non-US users

The app mainly serves local US customers and does not support international phone number registration or foreign bank account binding, which limits its convenience of use worldwide.

2. Investment functions are not as good as professional platforms

Although it integrates J.P. Morgan's investment platform, its functions are slightly basic for professional investors, such as limited chart analysis and real-time transaction data.

3. Some functional areas are obviously differentiated

For example, customers in some states cannot apply for mortgages online or use some loan management functions, and need to handle them offline.

4. Limited automatic customer service replies

Although the virtual assistant is convenient, when dealing with complex issues, you still need to wait for the manual customer service to reply, and the efficiency is occasionally limited.

Reviews

Chase Mobile is a banking application with rich functions, security and reliability, and excellent user experience, which reflects the leading level of mainstream financial institutions in the United States in the field of mobile digital services. Whether it is daily account management, credit card operations, remote check deposits, or investment and financial services, Chase Mobile provides simple and efficient solutions and is widely praised by users.

Although there is still room for improvement in internationalization and some professional functions, overall, it is a digital banking tool suitable for the vast majority of American users. As JPMorgan Chase continues to advance its digital strategy, Chase Mobile is expected to integrate more innovative technologies in the future, such as AI smart financial advisors, personalized loan recommendations, cross-border transfer support, etc., to further enhance users' financial experience.

Ratings and Reviews

Write a Review

Write a Review

Download Leaderboard